Virginia

Medicare Supplement Insurance Plans in Virginia. Original Medicare (Part A and Part B) provides coverage for many hospital and medical services. However, Medicare Part A and B don't cover all costs, and you'll usually still be responsible for cost-sharing expenses like copayments and deductibles. Bills for out-of-pocket expenses can quickly add up for Medicare beneficiaries with health issues that require ongoing treatment or monitoring.

Medicare Supplement insurance plans in Virginia help to cover some of the costs not included in Original Medicare coverage. Also known as Medigap, these plans may help with copayments, coinsurance, deductibles, and other out-of-pocket expenses. Medicare Supplement insurance plans may also include coverage for the first three pints of blood and emergency medical services outside of the United States.

There are 10 types of Medigap plans available in most states, including Virginia. Each of the 10 plans is labeled with a different letter, and benefits are standardized across each letter category. This means that if you enroll in a Plan A in one Virginia county, you'll get the exact same benefits as a Plan A offered in a different county in the state.

Medicare Supplement insurance is meant to work alongside your Original Medicare coverage, and you'll need to remain enrolled in Medicare Part A and Part B for your hospital and medical coverage. Medigap plans don't cover prescription drugs; if you want help with medication costs, you'll need to enroll in a stand-alone Medicare Prescription Drug Plan for this coverage.

Enrolling in Medicare Supplement insurance plans in VirginiaIn Virginia, you're generally eligible for Medicare Supplement insurance once you're enrolled in Medicare Part A and Part B. In addition, Medigap plans may be available to beneficiaries under 65 who qualify because of disability or certain conditions.

In general, the best time to enroll in Medicare Supplement insurance is during your six-month Medigap Open Enrollment Period. This is the one-time period that starts automatically once you're 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed-issue rights, meaning you can't be turned down for Medigap coverage because of pre-existing conditions or health problems. In addition, insurance companies can't charge higher premiums because of health or require medical underwriting. Once this period is over, you may not have guaranteed-issue rights, and you may have difficulty enrolling in Medigap coverage if you have health problems. In some situations, you may be able to enroll in or switch Medicare Supplement insurance plans with guaranteed issue. For example, if your Medigap plan goes bankrupt or breaks the rules, you may be eligible to enroll in a different plan with guaranteed-issue rights.

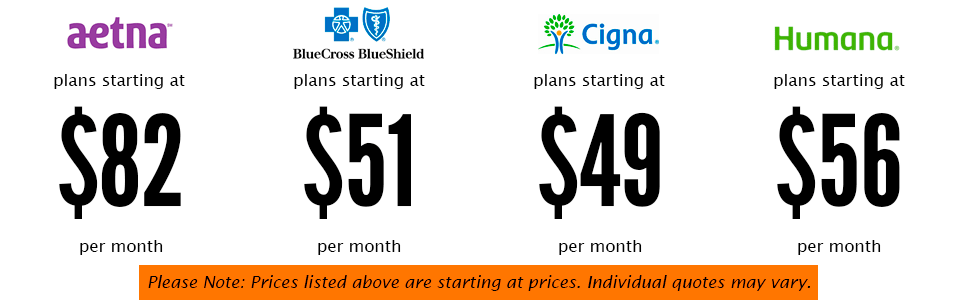

Comparing Medicare Supplement insurance plans in Virginia , as mentioned, Medicare Supplement benefits are standardized for plans of the same letter type. However, while the benefits are the same within each plan category, the costs for those plans can vary considerably. Costs may depend on the insurance company offering the Medigap plan and the location where the plan is offered. For example, a resident of Sussex County in Virginia may pay a different monthly premium for a plan than a resident of Scott County would pay for the same plan.

When comparing Medicare Supplement insurance plans in Virginia, it may be helpful to first determine the plan type that fits the level of coverage you need. Once you've narrowed down the Medigap plan type that fits your needs, you can get quotes from insurance companies in your service area to compare the costs. Keep in mind that Medigap plans with lower monthly premiums may have higher out-of-pocket expenses, so always review the overall cost of the plan to make sure you get the best value for your needs.

Need help finding Medigap coverage options that may fit your situation? Contact eHealth to discuss your Medicare questions with a licensed insurance agent.

Medicare Supplement Insurance Plans in Virginia. Original Medicare (Part A and Part B) provides coverage for many hospital and medical services. However, Medicare Part A and B don't cover all costs, and you'll usually still be responsible for cost-sharing expenses like copayments and deductibles. Bills for out-of-pocket expenses can quickly add up for Medicare beneficiaries with health issues that require ongoing treatment or monitoring.

Medicare Supplement insurance plans in Virginia help to cover some of the costs not included in Original Medicare coverage. Also known as Medigap, these plans may help with copayments, coinsurance, deductibles, and other out-of-pocket expenses. Medicare Supplement insurance plans may also include coverage for the first three pints of blood and emergency medical services outside of the United States.

There are 10 types of Medigap plans available in most states, including Virginia. Each of the 10 plans is labeled with a different letter, and benefits are standardized across each letter category. This means that if you enroll in a Plan A in one Virginia county, you'll get the exact same benefits as a Plan A offered in a different county in the state.

Medicare Supplement insurance is meant to work alongside your Original Medicare coverage, and you'll need to remain enrolled in Medicare Part A and Part B for your hospital and medical coverage. Medigap plans don't cover prescription drugs; if you want help with medication costs, you'll need to enroll in a stand-alone Medicare Prescription Drug Plan for this coverage.

Enrolling in Medicare Supplement insurance plans in VirginiaIn Virginia, you're generally eligible for Medicare Supplement insurance once you're enrolled in Medicare Part A and Part B. In addition, Medigap plans may be available to beneficiaries under 65 who qualify because of disability or certain conditions.

In general, the best time to enroll in Medicare Supplement insurance is during your six-month Medigap Open Enrollment Period. This is the one-time period that starts automatically once you're 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed-issue rights, meaning you can't be turned down for Medigap coverage because of pre-existing conditions or health problems. In addition, insurance companies can't charge higher premiums because of health or require medical underwriting. Once this period is over, you may not have guaranteed-issue rights, and you may have difficulty enrolling in Medigap coverage if you have health problems. In some situations, you may be able to enroll in or switch Medicare Supplement insurance plans with guaranteed issue. For example, if your Medigap plan goes bankrupt or breaks the rules, you may be eligible to enroll in a different plan with guaranteed-issue rights.

Comparing Medicare Supplement insurance plans in Virginia , as mentioned, Medicare Supplement benefits are standardized for plans of the same letter type. However, while the benefits are the same within each plan category, the costs for those plans can vary considerably. Costs may depend on the insurance company offering the Medigap plan and the location where the plan is offered. For example, a resident of Sussex County in Virginia may pay a different monthly premium for a plan than a resident of Scott County would pay for the same plan.

When comparing Medicare Supplement insurance plans in Virginia, it may be helpful to first determine the plan type that fits the level of coverage you need. Once you've narrowed down the Medigap plan type that fits your needs, you can get quotes from insurance companies in your service area to compare the costs. Keep in mind that Medigap plans with lower monthly premiums may have higher out-of-pocket expenses, so always review the overall cost of the plan to make sure you get the best value for your needs.

Need help finding Medigap coverage options that may fit your situation? Contact eHealth to discuss your Medicare questions with a licensed insurance agent.

Talk to a Local Certified Agent. So you can best be served!